Muthoot FinCorp Ltd announces XVII Tranche II series of NCDs, aims to raise Rs 250 cr

Kolkata: Muthoot FinCorp Ltd has announced XVII Tranche II series of secured, redeemable, non-convertible debentures of face value of Rs 1000 each to raise an amount aggregating to Rs 250 crore which is within the shelf limit of Rs 2000 crore.

This is the Tranche II issuance from the company.

The XVII Tranche II issuance amounts to Rs 75 crore with a green shoe option of Rs 175 crore aggregating up to Rs 250 crore.

The XVII Tranche II Issue has been open to public from October 11, 2024 and closes on October 24, 2024 subject to an early closure as may be approved by our Board of Directors or the Stock Allotment Committee thereof of the company, and subject to relevant approvals, in accordance with the Regulation 33A of the Securities and Exchange Board of India (Issue And Listing Of Non-Convertible Securities) Regulations, 2021, as amended (SEBI NCS Regulations).

The NCDs under the XVII Tranche II Issue are being offered with maturity/tenure options of 24, 36, 60, 72 and 92 months, with monthly, annual and cumulative payment options across different Options – I, II, III, IV, V, VI, VII, VIII, IX, X, XI, XII and XIII from which the customers can conveniently choose.

Effective yield (per annum) for the NCD holders in all categories of investors ranges from 9.00% to 10.10%.

The NCDs issued under XVII Tranche II have been rated at CRISIL AA-/Stable (pronounced as CRISIL double A minus rating with a Stable outlook) by CRISIL Ratings Limited and is proposed to be listed on the debt market segment of BSE.

The funds raised through the Tranche II Issue will be used for onward lending, financing, and for repayment/prepayment of interest and principal of existing borrowings of our company and for the general corporate purposes.

"We are happy to announce the next series of NCDs offering secure investment opportunities to our valued investors. Investors can conveniently invest through any of Muthoot FinCorp’s 3,700+ branches across the country or effortlessly via our mobile app, Muthoot FinCorp ONE, for investments up to Rs 5 lakhs from the comfort of their homes,” said Shaji Varghese, CEO – Muthoot FinCorp Limited.”

IBNS

Senior Staff Reporter at Northeast Herald, covering news from Tripura and Northeast India.

Related Articles

CRR cut, AI ethics push, and SORR benchmark: Experts hail RBI’s pragmatic policy moves

Mumbai: The Reserve Bank of India (RBI) has kept the repo rate unchanged at 6.5% while the cash reserve ratio (CRR) has been slashed by 50 basis points to 4 percent, media reports said.

JP Morgan gives 'overweight' rating to Adani Group bonds

Mumbai: US investment bank JP Morgan has assigned an 'overweight' rating to four bonds issued by the Adani Group, citing the group's capacity to scale and grow through internal cash flows, which reduces the likelihood of credit stress.

LG Electronics files DRPH with SEBI; IPO size expected to be over RS 15,000 cr

Mumbai: South Korean electronics giant LG Electronics has filed a draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) on Friday for the proposed public listing of its Indian business, according to a notification on the Bombay Stock Exchange (BSE).

De-dollarisation not on India's agenda; derisking domestic trade is: RBI Governor Shaktikanta Das

Mumbai: India has not initiated any steps towards de-dollarisation and is solely focused on mitigating risks to domestic trade from geopolitical uncertainties, Reserve Bank of India (RBI) Governor Shaktikanta Das clarified on Friday, media reports said.

Latest News

Canada: Eight Toronto police officers charged in major corruption probe

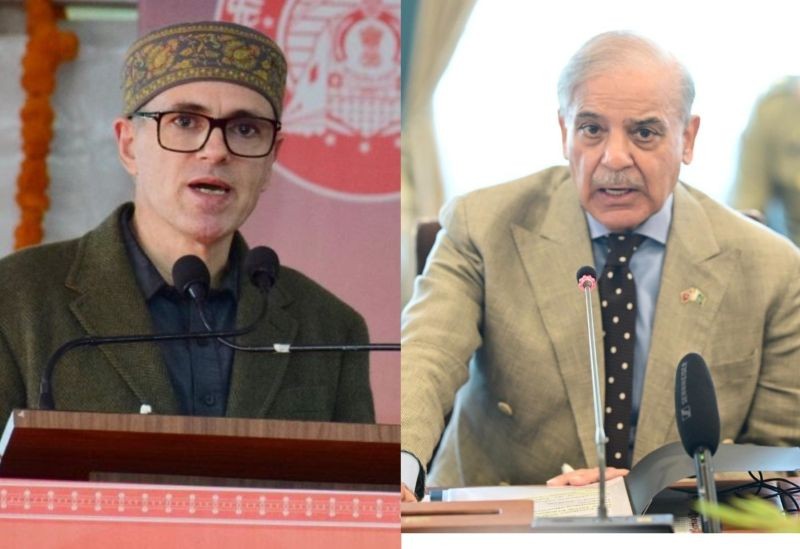

They can’t handle what they already have: Omar Abdullah snaps back at Pak PM over Kashmir remark

US imposes new sanctions on Iran amid nuclear talks in Oman

'The people rejected you': Supreme Court dismisses Jan Suraaj plea challenging Bihar election results